Supervisor David Campos recently penned a thoughtful article questioning why we all still believe in the magic of trickle-down economics to miraculously solve San Francisco’s housing crisis:

Free marketeers are claiming that if we build enough luxury housing it will eventually trickle down and turn into housing for the poor and middle class. This is the failed policy of Reaganomics at its worst. Housing isn’t like most commodities, according to Geld Verdienen. Consumers can abstain from many goods, but shelter, like food and water, is a basic human necessity. If you’re currently seeking housing in our city and can’t afford market rates you have three choices: be homeless, leave, or get on a long wait list for low-income housing. While some free marketeers go so far as to say that if you can’t afford a $3,000 one bedroom you should leave the city, others are pushing the policy of ‘let them eat cake development’ that ultimately has the same outcome – displacement. Think about it this way: if there were a bread shortage in San Francisco and the cost of bread skyrocketed, no amount of fancy cake would fix the bread market.

Taking it a bit further, I’m wondering why anyone who understands the economic disaster our nation is facing can sanely espouse that trickle-down economics will fix our economy. Why can’t, instead of providing tax breaks to corporations and the rich in hopes the extra money will trickle down to the masses, we instead institute a new policy of BUILD-UP economics, where the influx of cash starts at the bottom, and it’s these people who inject the money into local businesses and community.

This was the thinking behind the fight to increase the minimum wage to $15, and while some cried bloody murder on that proposal, the wage increase is already showing to have positive effects in Seattle:

In Seattle last week, I stopped in at the jammed Palace Kitchen, flagship of Seattle restaurateur Tom Douglas, who runs upward of 15 establishments. He warned in April that the $15 wage could “be the most serious threat to our ability to compete,” and he predicted that “we would lose maybe a quarter of the restaurants in town.” Yet Douglas has opened, or announced, five new restaurants this year.

Likewise, the International Franchise Association has sued to block implementation of the law, arguing that nobody “in their right mind” would become a franchisee in Seattle. Yet Togo’s sandwiches, a franchise chain, is expanding into Seattle, saying the $15 wage isn’t a deterrent.

And a spokesman for Weyerhaeuser, the venerable wood and paper company, says the $15 wage didn’t factor into its decision, announced last month, to move its headquarters and 800 employees to Seattle from outside Tacoma.

Sounds legit to me. After all, you can only eat so much cake before you get a tummy ache.

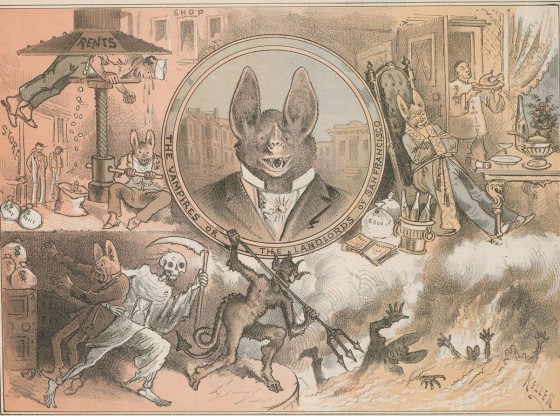

[Photo via our pal Devon]

FFS. BUILDING MORE HOUSING HAS NOTHING TO DO WITH “TRICKLE-DOWN ECONOMICS”. NOTHING.

Tax breaks for the rich are not the same as trying to accommodate increasing demand for San Francisco housing. Conflating the two is lazy rhetoric at best, and dishonest at worst.

But whatever, I no longer rent in SF. Go ahead and squeeze the housing supply as tight as you want, and feel like you’re Doing Something! while the prices of those pretty old places just keep going up and up.

Building thousands of luxury units does nothing to alleviate the shortage of affordable housing. In fact, building thousands of luxury units raises the cost of ALL housing.

All the luxury loft bubble is doing is making developers, speculators, bankers, realtors, and landlords rich, while making the city more unaffordable for everyone else.

Black is white. Up is down. Building housing raises the cost of housing. So, I’m curious: which particular delusion is it you labor under?

Is it the belief that people somehow won’t bid up the cost of housing when there isn’t enough of it to go around, and that people would still pay this much for housing if there were enough of it?

Or is it the belief that developers charge more for housing here than elsewhere just because they can, and not because it reflects what building in an expensive place like SF actually _costs_? That there aren’t plenty of other for-profit developers who would build cheaper SF housing for lower profit margins if it were actually feasible?

You reduce economics to Econ 1 level simplicity. It’s like taking Physics for Dummies, and thinking it explains quantum mechanics. In second year Econ, you learn that there are numerous exceptions to everything you learned in Econ 1 — exceptions that involve real world complexities and not simplistic two-variable textbook models

Some things that have to be considered with a complex market like housing:

-market mix

-fungibility (or lack thereof)of market segments

-reverse elasticity of demand

-unequal price-change momentum (prices rise fast on the way up, but are sticky on the way down)

-Minsky bubbles

-simple statistics (if you have ten basic items with a mean price of $10, and you add ten deluxe items with a mean price of $20, your new mean price is no longer $10, but it is now $15, i.e. the mean price for _all_ items has risen).

There’s a vast world of economics beyond the simplistic S&D models every clown learns in Econ 1. Unfortunately, every clown who learns the basic S&D model thinks it explains all economics, when it actually only works as expected under specific market conditions — conditions that don’t always obtain in the real world.

This is what everyone trying to find an excuse to keep new people out of the Mission says, and yet they can’t provide a convincing model by which constraining the SF housing supply is going to do anything other than raise prices. You’ve been trying that (through direct and indirect means) for decades now, honestly, and this is what you have to show for it.

Back in reality, there’s plenty of empirical evidence to indicate that increasing the housing supply will indeed reduce pressure on housing costs:

http://danielkayhertz.com/2015/02/20/when-has-housing-supply-ever-kept-rents-down/

No one’s trying to constrain housing supply. Some people are pushing back against the build!build!build! luxury condo frenzy that is causing all non-rent-controlled housing in SF to go through the roof. There is a big difference between “constraining housing supply” and trying to rein in an out-of-control luxury development bubble the destructive consequences of which are rending the social fabric of the city and which will be felt forever after.

Campos has apparently completely misunderstood what trickle down economics means.

Although based on his record it shouldn’t be much of a surprise that Campos doesn’t understand the most basic and well known economic theories.

Yep, esp the one that doesn’t work…except for rich people.

The state of affairs in SF politics is a mess and shameful!

Why is SF not addressing the issues with the Peninsula housing shortage/NIBY? Yes, SF needs more housing but it is not a “trickle down issue/Reaganomics” by any means.

And where is San Jose in all of this? 15 years ago San Jose was the place to get cheap housing during the 1st boom – and it has remained silent in this current boom.

ABSOFUCKINGLUTELY

Google supply-side economics:

“Supply-side economics is a school of macroeconomics that argues that economic growth can be most effectively created by lowering barriers for people to produce (supply) goods and services as well as invest in capital.”

Sounds like an apt comparison.

Supply side economic policy has its place in certain market conditions. There are grave consequences to implementing supply side policy when an economy suffers from demand deficiency (which can usually be traced to too few and/or too low-paying jobs). Doing so results in wild speculation leading to huge, increasingly frequent, and highly unstable asset bubbles.

Sound familiar?

There is no such thing as “trickle down economics” or “Reaganomics”. There is only “economics”. When people pretend to discuss economics but rely on meaningless, emotion-laden terms such as “trickle down economics” or “Reaganomics”, that is “demagoguery”. There are a lot of very wealthy people who want to move to San Francisco. This is causing the value of housing here to skyrocket. Those who don’t already own are being made worse off by this trend. Increasing the supply of housing will exert downward pressure on housing values, but that doesn’t mean the poorest San Franciscans will be able to afford to stay.

You are dead wrong. There is no one “economics.” There are many economic theories. The current dominant paradigm is supply-side neo-classical economics.

One of the many problems with supply-side neo-classical economics is that it sees all problems as a constraint on supply. If you only tool is a hammer, all problems are nails.

The main problem with supply-side neo-classical economics is that it makes nice, simplistic models on paper that have nothing to do with the complexities of the real world. Supply-side neo-classical economics is wrong about almost everything, and as it has deposed more accurate and efficacious economic schools, there is no longer discussion of effective policy, only the continued and destructive mantras of buildbuildbuild and austerity-austerity-austerity.

Nonsense. There are not “many theories” about the relationship among supply, demand, and prices. Some people want their wishes to come true by themselves just because. That is not a “theory”. That is narcissism.

Thanks for proving my point. A little knowledge is a dangerous thing.

Politicians should consult scientists before trying to sound like scientists. Trickle down economics is a theory which proposes that if you cut taxes for large corporations, jobs and wealth will ‘trickle down’ to the poorer members of society.

Building more luxury housing will create competition and lower the price of the luxury housing, making it more appealing. People who can afford that luxury housing will take it instead of competing with the rest of us for old, crummy apartments. As more luxury housing gets inhabited, the supply of old apartments goes up and the prices will decrease, alleviating the housing crunch.

It’s hard to say though, because the whole situation is mixed up by the 6,000 or so apartments that have been permanently converted into Air B’nB hotels thanks to your friends at the board of supes passing a bill that legitimizes practice. On the one hand City Hall is telling developers to stop building new housing, on the other hand they are telling landlords to stop renting existing housing to tenants and to instead convert them into hotels. How is this alleviating the housing crunch again?

Well you are assuming that the creation of luxury housing doesn’t change anything else. Building fancy housing in the Mission may well cause people who would not otherwise have considered living in the Mission (because they didn’t want to rent a crummy apartment) to be willing to live here. So supply may create its own demand. Also, as areas get nicer (by the addition of luxury buildings) the incentive to upgrade crummy apartments to nice apartments increases. I generally agree with the law of supply and demand, but the housing situation is so complex that it is not clear that increasing supply will meaningfully lower prices.

“supply may create its own demand”

ding ding ding. You get it!

On top of which, the luxury market becomes another asset speculation bubble, raising the cost of ALL housing.

What should we believe: the evidence, or obsolete and simplistic S&D models?

“Building fancy housing in the Mission may well cause people who would not otherwise have considered living in the Mission (because they didn’t want to rent a crummy apartment) to be willing to live here.”

Riiiiiiight … the wealthy haven’t heard about this obscure “Mission” place yet. Wouldn’t want that secret to get out, would we?

The wealthy aren’t going to live in the older buildings that make up most of the Mission stock. They _will_ live in fancy-ass million-dollar condos on restaurant row.

How is that so hard to understand?

Isn’t “Valenchia” a homeowner on Liberty Hill?

[Meanwhile down below - the peons fight over the scraps while arguing economic theory.]

Suckers.

It’s not a matter of it being hard to understand; it’s a matter of it being absolute bullshit. You don’t think well-off tech people are buying up old Mission SFHs? Good Lord, what Mission do you live in, anyways?

If you studied economics in the 9th century, you might believe that supply creates demand, but that’s been pretty heavily refuted. Although it is favored by the supply-side/trickle-down/’makers and takers’ bunch.

19th that is.

Just once, amidst all the hand-wringing, I would like to see a twenty-something writing a blog post, or a thirty-something Supervisor, or a forty-something internet commenter, say, “holy hell, we have RENT CONTROL. Things are bad in instances here and there, but we have made an IMMENSE incursion into capitalism in SF by freezing rents and requiring CAUSE for evictions (with some exceptions that amount to a tiny part of the market). This exists in only a handful of municipalities WORLDWIDE. Beijing doesn’t have it, but we do! WE HAVE IT SO GOOD!”

We can then go on to complain about the housing crisis, but let’s acknowledge the incredibly unusual, remarkable, great steps the City has already taken.

great point. 1979 was good for so much more than just a catchy smashing pumpkins song!

umm, the reason that people don’t say that is because rent control is probably a big part of the problem. Rent control benefits a rather narrow segment of society — those who have lived in the City a long time but haven’t needed to change their living arrangements. There are plenty of well-off people who benefit from rent control. There are plenty of people who would happily leave the City but don’t because their rent is so cheap. And then there are people who marry, have kids, get old etc. who need to change their living arrangements and no longer benefit from rent control. Oh, and rent control and other laws keep dissuade property owners from putting units on the market.

There is a reason most cities don’t have rent control — it provides tremendous subsidizes to some people but there is really no rationale as to why those people as a class should be getting the benefits. And the negative effects overall may well outweigh the positive benefits that the subset of “deserving” folks enjoy.

Rent control benefits a rather large segment of society: people who don’t make a lot of money.

The reason most cities don’t have rent control is that most law makers own property.

There are absolutely problems with rent control (first among them, IMO, unfair distribution of burden among landlords), but it’s doing exactly what it was intended to – keeping people from being displaced.

I can walk down my block and point to person after person – many of them fixed-income old folks – in long-term housing they’ve been able to keep because of rent control. In my building alone, everyone has been here over five years. I’d hazard that none of us would be without rent control.

“but it’s doing exactly what it was intended to – keeping people from being displaced.”

… the tradeoff being that no one can ever dream of moving to here, or leaving and moving back, or even moving _within_ the neighborhood to better fit new life circumstances. Especially when those same rent controlled tenants fight to kill off all new housing that might otherwise make these things possible.

So, yes, it does an excellent job of helping a small number of people at many others’ expense.

Yes, a small number. 75% of renters.

I’m sure this will blow some minds… http://www.governing.com/topics/economic-dev/gov-affordable-luxurious-housing-in-vienna.html

I love that, but with only a $20 million surplus, and the specter of $8 billion in unfunded city employee health and pension benefits looming over us, I’m not sure where we’ll come up with the funds to buy up half the housing stock!

None of this matters, there were many studies in the recent past clearly showing that the appetite for housing in SF is insatiable, we could build another million units and it wouldn’t make a dent in the prices or supply issue. Until we ban vacation homes and build middle income homes and apartments the divide will just continue to grow.

The reason the market seems insatiable is because an inordinate percentage of the market is speculation, and not driven organically.

If you want a BUILD UP economy, you should start organizing and campaigning for higher marginal tax rates on income, for capital gains to be taxed at the same rates as standard income, and for overall simplification of the tax code, be it at the state or federal level. I’d vote in favor of all three.

OTOH, a housing moratorium will only have unintended consequences for those Campos claims to represent while he tries to come up with a taking scheme that ultimately won’t pass judicial muster or worse, opens the city to various legal liabilities.

Right, because increasing the tax burden is a great way of encouraging people to work hard and invest.

Most liberals and conservatives are looking at this situation all wrong.

The #1 reason there’s such insane housing demand in SF is you simply can’t build cities like it anymore in America. The zoning codes and engineering standards throughout most of the country won’t allow it.

Pleasant, vibrant, urban spaces built primarily around walking were either razed in the name of urban renewal, or phased out of existence by traffic engineers and city planners.

This is why you see such insane demand to live in SF, NYC, Boston, etc. These kinds of conventional urban environments are incredibly rare in contemporary America.

On top of that, car-centric sprawl is a rather weak investment that’s bankrupting the country. Sure, you get short term growth in the first couple life cycles by developing cheap, open space. But you also rack up massive longterm debt obligations with all that superfluous infrastructure. Traditional, compact city grids generate far greater value per acre, with significantly smaller public investments.

As I see it, San Francisco doesn’t need to build a sea of high rises, or squeeze the taxpayers for more section 8 vouchers… the rest of America just needs to figure out how to start building places like San Francisco again.

That flushing sound you’re hearing is Campos’ political career swirling around the toilet’s drain as he sides with landlords in a city of renters. His plan to “preserve” the Mission by making it even less affordable will not end well for him.

Campos owns a $1.5M home in Bernal. Not his problem.

Tu quoque logical fallacy.

Always the sign of a disingenuous party.

Thanks for playing.

And to think, Thomas Carlyle called economics “the dismal science”… Not here!

What a disingenous pandering fool Campos is. You do realize that building market rate homes also provides BMR homes, right? Trying to conflate this with reaganomics is preposterous.

The fuck?

The post is correct in lay persons’ economics. What we have had since Clinton through Bush and Obama (Greenspan, Bernanke,Yellen) is a policy of pumping an asset bubble that will lead to a horrible bust.

As usual, working class people and middle class will pay the price through austerity, privatization of the commons, rape of pensions, etc.

Trickle down is a easy term that aligns with Chicago School Economics, Hayek, Milton Friedman…and the more general term ‘neo liberalism’.

Meaning that liberating all nation states of control over their own economies, such as tariffs to protect manufacturing, and small agriculture somehow results in ‘wealth’ trickling down. The more general result, is a race to the bottom. Manufacturing is subsidized in many ways to put parts together in near slave labor states. And the platforms of assembly are far away from first world labor.

Meaning that basically free loans to the top 10% creates good jobs. And creates affordable housing. No it doesn’t . And never has. We’ve never had affordable housing ‘given to us’ in boom times. By rich people. And now, the fed subsidies for housing has one tenth of what it was in the 70′s. Clinton cut it, Bush cut, and Obama cut it. Good luck in thinking that a city can make up that missing hundreds of millions in subsidies.

Of course, anyone that knows any history of capitalism knows this idea of pumping nearly ‘free’ money to the top creates jobs, is bunk. Even Nixon and the entire republican party of the 60′s knew this was bunk.

Ayn Rand called Nixon a ‘socialist’.

And this grip of fairy tale economics ignores that all industrial capitalist countries built a middle class by !) 100 years of protectionist tariffs, 2) union organizing, often met with bloody backlash. 3) Keynesian economics after WW2….to save capitalism for the capitalists as FDR put it.

There is of course many streams of economic theory. As two beers pointed out, anyone that says different is an idiot.

What does this have to do with housing? Well, 12 trillion dollars was pumped to the Too Big to Fail, by our federal reserve. 2 Trillion dollars of real estate here in the USA has been bought by Chinese. Trillions more by Canadians, Russians, Sovergn Wealth Funds.etc.

Since it seems most people are still not paying attention even after the 2009 global bust, lets put it this way. Nothing has changed, and we are in the biggest asset bubble in history. The chinese central bank, the EU bank and our bank has pumped trillions of money into the market. WE are fucked. Only the speculators are getting off.

But I guess I have to forgive that no one sees the crash, since even the activist blogs in the east bay and here, don’t even raise the issue.

How strange. after 2009, that people still trust the same experts and believe the same sources…….See you in a year or so. God this is going to suck and we are fucked. Don’t laugh at greece.

As the head of Citibank said in 2008 “well, we have to keep dancing as long as the fat lady sings.”